Singaporeans Plan For Their Finances With Care

Financial planning is a structured approach towards achieving one’s financial goals, building wealth, preparing for emergencies and reducing financial stress. Let’s have a look at what HappyDotters think of financial planning.

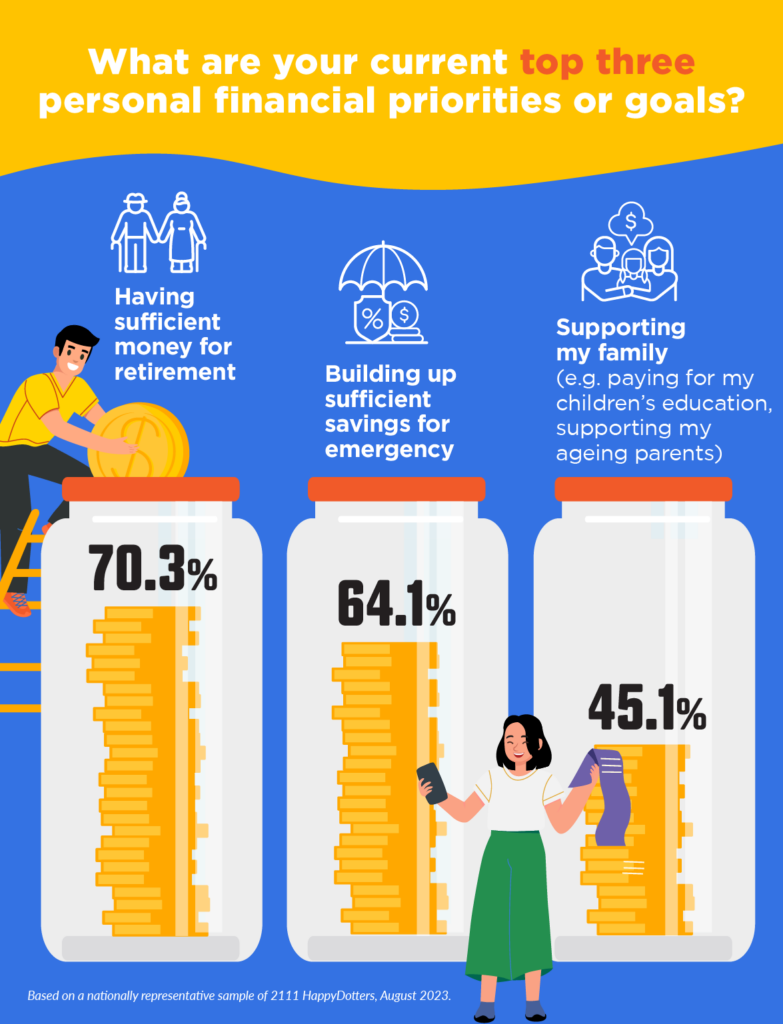

Singaporeans’ top two financial priorities are having enough funds for retirement and emergencies, an indication of their prudence and ability to plan for the long term. Coming in third is supporting their family, a reflection of the bread-and-butter concerns that affect the man in the street.

Close to 9 in 10 (87.6%) Singaporeans have started financial planning, a healthy sign of their financial maturity and responsibility. Almost 6 in 10 (59.4%) plan for their financial goals concurrently, a practical approach that can help provide a holistic overview of one’s financial situation. So, what have Singaporeans done to work towards attaining their financial goals?

Frugality appears to be the most preferred way of accumulating wealth, with 7 in 10 (73.3%) Singaporeans saving more/cutting down on daily expenses to achieve their financial goals. This is well complemented with having a passive income (46.6%) and increasing one’s salary through main employment (35.2%). Indeed, there are many ways to attain one’s financial aspirations and it is heartening to see Singaporeans exercising prudence in preparing for various situations in life.

Share your views on ongoing social issues in Singapore through our surveys and check out fresh insights of What Singapore Thinks every month!

Mingle with other HappyDotters and take part in other fun polls on our Telegram! LIKE our Facebook and FOLLOW our Instagram to know more about us.